From Passive Income Stream to Wealth Creation: Insights by Soniya Malik

From Passive Income Stream to Wealth Creation: Insights by Soniya Malik

Introduction

Passive income alone does not create lasting wealth, revenue from dividends, rental income, and digital assets can provide financial stability, true wealth creation requires strategic reinvestment, financial discipline, and long-term planning.

Many individuals generate passive income but fail to scale it into sustainable wealth due to poor financial management and lack of reinvestment strategies.

The U.S. wealth management industry is projected to reach $101.62 trillion by 2029, highlighting the importance of structured financial planning in turning income streams into generational wealth.

Simply accumulating money is not enough; what matters is how that money is managed, reinvested, and grown over time.

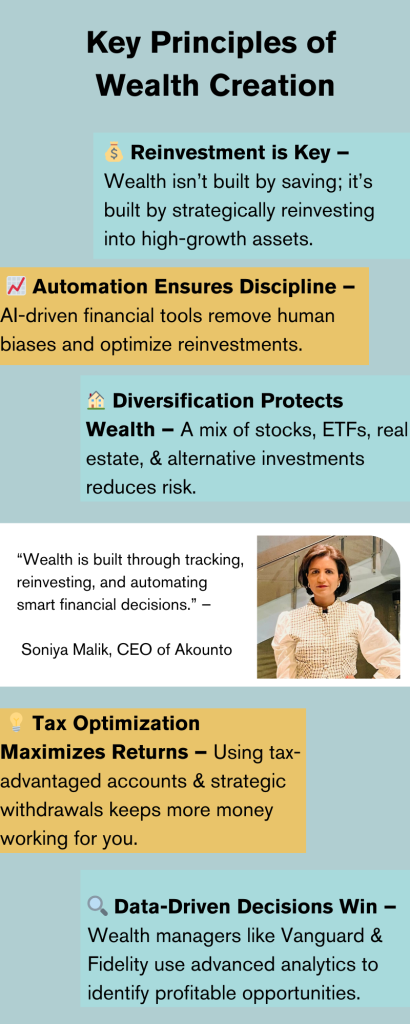

Soniya Malik, Founder and CEO of Akounto, emphasizes the role of financial tracking, automation, and smart investment strategies in wealth management. “Most people focus on making money, but very few focus on managing and growing it efficiently. With the right financial tools and reinvestment mindset, passive income can be transformed into long-term wealth,” she says.

Technology and automation are redefining how wealth is managed. The rise of AI-driven financial tools, automated investment platforms, and algorithm-based wealth management has made it easier to track, optimize, and scale financial assets with minimal effort.

Wealth creation is no longer reserved for the ultra-rich—it is accessible to anyone willing to take a structured approach to financial growth.

Moving Beyond Passive Income – The Real Path to Wealth

Generating passive income is just the beginning. Dividends, rental income, royalties, and digital assets can provide financial stability, but they do not automatically create long-term wealth. The key is reinvestment. Without reinvesting, earnings remain stagnant, and inflation erodes purchasing power over time.

Many entrepreneurs and investors fall into the profit trap—spending what they earn instead of making money work for them.

Soniya Malik, Founder and CEO of Akounto, warns against this mindset. “Wealth isn’t built by taking home all the profits. Every dollar that isn’t reinvested is a missed opportunity for future growth. Automation ensures that reinvestment happens consistently, without emotion-driven decisions.”

Financial mismanagement is one of the biggest barriers to wealth accumulation. Many individuals assume that earning passive income is enough, but without structured financial tracking and disciplined reinvestment, money gets wasted on short-term expenses rather than compounding into assets.

Consider the difference between two investors:

- Investor A earns $50,000 annually from rental properties but spends most of it on lifestyle upgrades.

- Investor B earns the same amount but reinvests 70% into additional properties, stock market index funds, and automated trading portfolios.

After ten years, Investor A still owns the same properties, while Investor B has built a diversified portfolio, generating three times the passive income. The only difference? A structured reinvestment strategy.

Automation plays a pivotal role in ensuring reinvestments happen without delays or emotional biases. AI-powered financial tools now allow investors to automatically allocate earnings into diversified assets, reinvest dividends, and optimize tax-efficient strategies.

Those who treat passive income as a reinvestment engine rather than a paycheck will see exponential financial growth. Wealth is not about how much you earn—but about how well you deploy capital to create more wealth.

Soniya Malik’s Strategy: Reinvesting Smartly to Scale Passive Income into Wealth

Reinvesting for Growth – Let Your Money Work for You

Earnings should never sit idle. Reinvesting into stocks, ETFs, real estate, and alternative assets ensures that passive income compounds over time. Firms like Vanguard and Charles Schwab advocate for automated reinvestment strategies to maximize returns.

Soniya Malik emphasizes reinvestment as a non-negotiable rule. “Wealth isn’t built by saving—it’s built by strategically redeploying capital into growth assets. Without reinvestment, money loses value.”

Consider an investor earning $10,000 annually in dividends. If that amount is spent, growth stops. If it’s reinvested into ETFs yielding 8% annually, it turns into $215,000 in 20 years—without adding extra funds.

Leverage Tax Optimization – Keep More of What You Earn

Tax inefficiencies eat into wealth. Smart investors use tax-advantaged accounts (IRAs, 401(k)s), capital gains tax planning, and tax-loss harvesting to reduce liabilities.

Wealth management firms like Fidelity and Merrill Lynch help high-net-worth individuals structure tax-efficient portfolios that minimize taxable events. Strategic asset location—placing high-yield investments in tax-advantaged accounts—further preserves income.

Diversify to Protect and Multiply Wealth

Markets fluctuate, but a diversified portfolio safeguards against downturns. Real estate, dividend stocks, commodities, and alternative investments (like REITs or private equity) create a strong financial foundation.

For example, during the 2008 financial crisis, investors with diversified assets (gold, bonds, real estate) saw smaller losses than those solely in stocks. Malik stresses diversification as essential: “A single income stream is a vulnerability. True financial strength lies in a well-diversified, resilient portfolio.”

Smart reinvestment, tax planning, and diversification separate those who simply earn from those who build lasting wealth.

Soniya Malik on Role of Automation in Wealth Creation

Automation has become a cornerstone in modern wealth management, enabling individuals and firms to streamline operations, enhance decision-making, and optimize investment strategies. Several tools and platforms have emerged as leaders in this space:

- Masttro: Offers comprehensive wealth management solutions, integrating data aggregation, reporting, and analytics to provide a holistic view of one's financial landscape.

- Addepar: Provides data-driven investment management platforms, allowing for detailed portfolio analysis and performance tracking.

- SS&C Black Diamond: Delivers client reporting and portfolio management solutions, enhancing advisor-client interactions through transparent data presentation.

These platforms exemplify how automation facilitates efficient wealth management by reducing manual processes and minimizing errors.

Akounto, under the leadership of CEO Soniya Malik, integrates automation to assist users in tracking income, expenses, and investments seamlessly. Malik emphasizes the importance of automation in wealth creation: "Automation is not just about efficiency; it's about empowering individuals to make informed financial decisions without the burden of manual tracking."

The advent of AI agents and robo-advisors has further revolutionized the industry. These AI-driven platforms utilize machine learning algorithms to provide personalized investment advice with minimal human intervention. For instance, Betterment has emerged as a prominent robo-advisor, offering automated portfolio management tailored to individual financial goals.

Moreover, companies like Robinhood are integrating AI-powered financial advice into their platforms, aiming to democratize access to investment guidance. In 2025, Robinhood announced plans to launch AI-driven advisory services, making sophisticated financial advice accessible to a broader audience.

The integration of AI and automation in wealth management not only enhances operational efficiency but also democratizes access to sophisticated financial strategies, enabling a broader demographic to participate in wealth-building opportunities.

Future-Proofing Wealth: Long-Term Investment Strategies

Long-term investing offers numerous benefits that can help you achieve your financial goals despite short-term volatility.

Case Studies of Successful Long-Term Investors

- Warren Buffett: In 1988, Buffett invested $1 billion in Coca-Cola, a stake he still holds today. This long-term commitment has yielded substantial returns, exemplifying the benefits of patience and confidence in one's investment choices.

- Anne Scheiber: A former IRS auditor, Scheiber amassed a $22 million fortune by investing her modest earnings into blue-chip stocks over several decades. Her disciplined approach underscores the power of long-term investing and compounding growth.

The Role of Financial Advisors and Tech-Driven Solution

Financial advisors play a pivotal role in guiding investors toward long-term wealth creation. They provide personalized strategies, risk assessment, and ongoing support to align investments with individual goals. In recent years, technology has enhanced this process:

- Robo-Advisors: Platforms like Betterment and Wealthfront offer automated, algorithm-driven financial planning services, making long-term investing accessible to a broader audience.

- AI-Powered Tools: Advanced analytics and machine learning assist in portfolio optimization, risk management, and identifying growth opportunities, thereby supporting informed decision-making.

Integrating professional advice with technological advancements ensures a comprehensive approach to future-proofing wealth, enabling investors to navigate complexities and capitalize on long-term opportunities.

By embracing long-term investment strategies, learning from successful investors, and leveraging both human expertise and technological innovation, individuals can effectively safeguard and grow their wealth over time.

Soniya Malik on Smart Wealth Building for the Future

Long-term wealth creation isn’t about making quick profits—it’s about strategic reinvestment, financial discipline, and leveraging automation. Smart investors focus on compounding growth, ensuring their money works for them over time.

Soniya Malik, CEO of Akounto, emphasizes automation as a game-changer in wealth management. “Financial success isn’t just about earning—it’s about tracking, reinvesting, and optimizing. Automation ensures discipline, removing emotional biases from investment decisions.”

One key strategy is automated reinvestment—allocating dividends, rental income, or stock gains into diversified assets without manual intervention. Wealth managers like Vanguard and Fidelity use this approach to help clients scale investments effortlessly.

Another strategy is tax optimization—using tax-advantaged accounts and strategic withdrawals to minimize tax burdens and maximize net returns. When paired with data-driven decision-making, these strategies help individuals turn passive income into sustainable wealth.