AI and Fintech in Wealth Management: Insights by Soniya Malik – Founder and CEO of Akounto

AI and Fintech in Wealth Management: Insights by Soniya Malik – Founder and CEO of Akounto

AI-driven insights, robo-advisors, and predictive analytics are replacing traditional financial planning making wealth management smarter and more efficient.

Financial firms like BlackRock, Morgan Stanley, and Fidelity already use AI for risk assessment, algorithmic trading, and automated portfolio management. The AI in fintech market is projected to reach $61.3 billion by 2031.

AI and fintech are transforming wealth management by automating investment decisions, optimizing portfolios, and democratizing access to financial tools. is being replaced by

Soniya Malik, Founder and CEO of Akounto, emphasizes automation’s role: “AI is no longer an option—it’s a necessity. The ability to track, manage, and optimize wealth in real time is redefining financial success.”

From robo-advisors to AI-powered trading models, technology is making wealth management faster, more precise, and accessible to all.

The Role of AI in Wealth Management

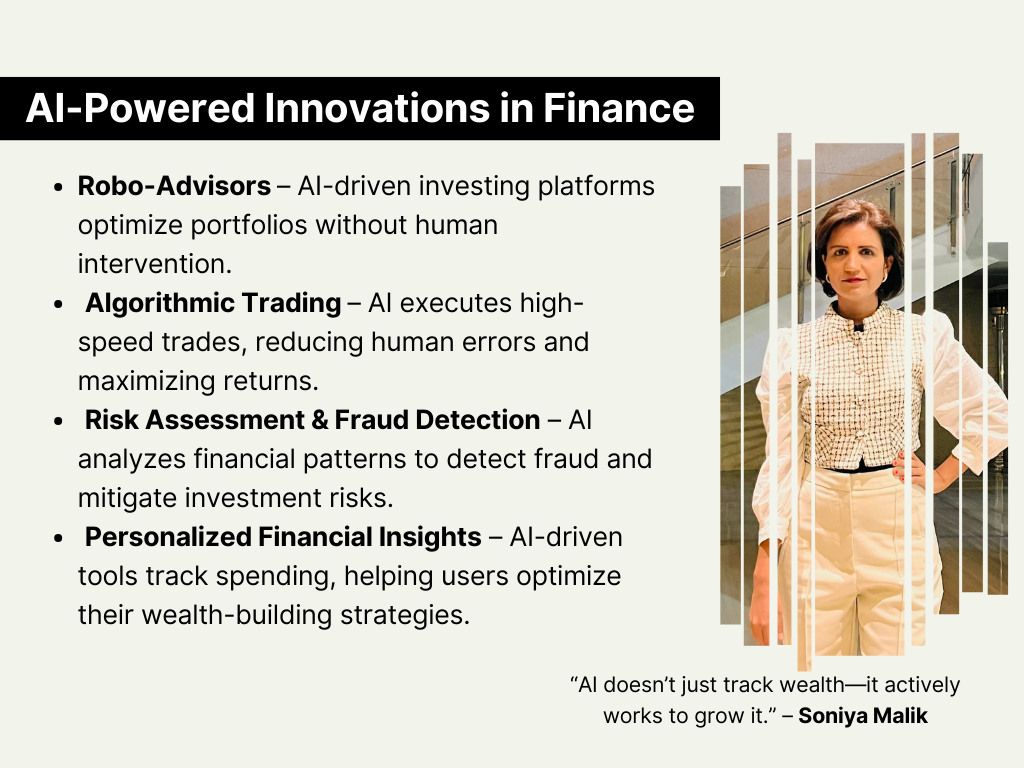

AI is redefining wealth management by analyzing massive financial data, predicting market trends, and optimizing investment strategies in real time. Traditional financial advisory is giving way to AI-driven portfolio management, automated risk assessments, and algorithmic trading.

BlackRock’s Aladdin AI analyzes market risks and suggests optimal asset allocations. Morgan Stanley’s AI modeling enhances investment strategies by processing complex financial patterns. Fidelity’s AI-assisted trading system executes trades with precision, minimizing losses and maximizing gains.

AI-driven financial tools offer hyper-personalized investment strategies, adjusting portfolios based on real-time market conditions and investor preferences. AI-powered insights help reduce risk, improve returns, and eliminate emotional decision-making in wealth management.

Soniya Malik sees AI as the future: “AI doesn’t just track wealth—it actively works to grow it. The ability to make data-driven financial decisions in real time is a game-changer.”

From automated asset allocation to real-time risk analysis, AI is making wealth management smarter, faster, and more efficient than ever before.

Robo-Advisors & Algorithmic Investing

Robo-advisors are transforming wealth management by automating portfolio management, reducing costs, and providing data-driven investment strategies. These AI-powered platforms use algorithms to allocate assets, rebalance portfolios, and minimize risks without human intervention.

| Leading Robo-Advisors in Wealth Management | ||

| Company | Robo-Advisor Name | Description |

| Betterment | Betterment Digital | Fully automated investing with tax-loss harvesting and goal-based planning. |

| Wealthfront | Wealthfront Automated | AI-driven portfolio management with tax-efficient investing and smart rebalancing. |

| Charles Schwab | Schwab Intelligent Portfolios | No advisory fees, diversified portfolios managed using AI-driven strategies. |

| Vanguard | Vanguard Digital Advisor | Combines algorithmic investing with access to human advisors. |

| Morgan Stanley | Next Best Action AI | AI-driven investment recommendations for wealth management clients. |

The Impact of Robo-Advisors on Investing

Robo-advisors have democratized wealth management, making professional-level investment strategies accessible to retail investors with low fees and automated portfolio adjustments. They use machine learning and predictive analytics to optimize asset allocation based on risk tolerance, market conditions, and investment goals.

According to Statista, robo-advisors are expected to manage over $3 trillion in assets globally by 2027, signaling growing investor trust in AI-driven financial planning. As human advisors shift to more complex financial planning roles, robo-advisors continue to handle automated investing, tax optimization, and wealth-building strategies efficiently.

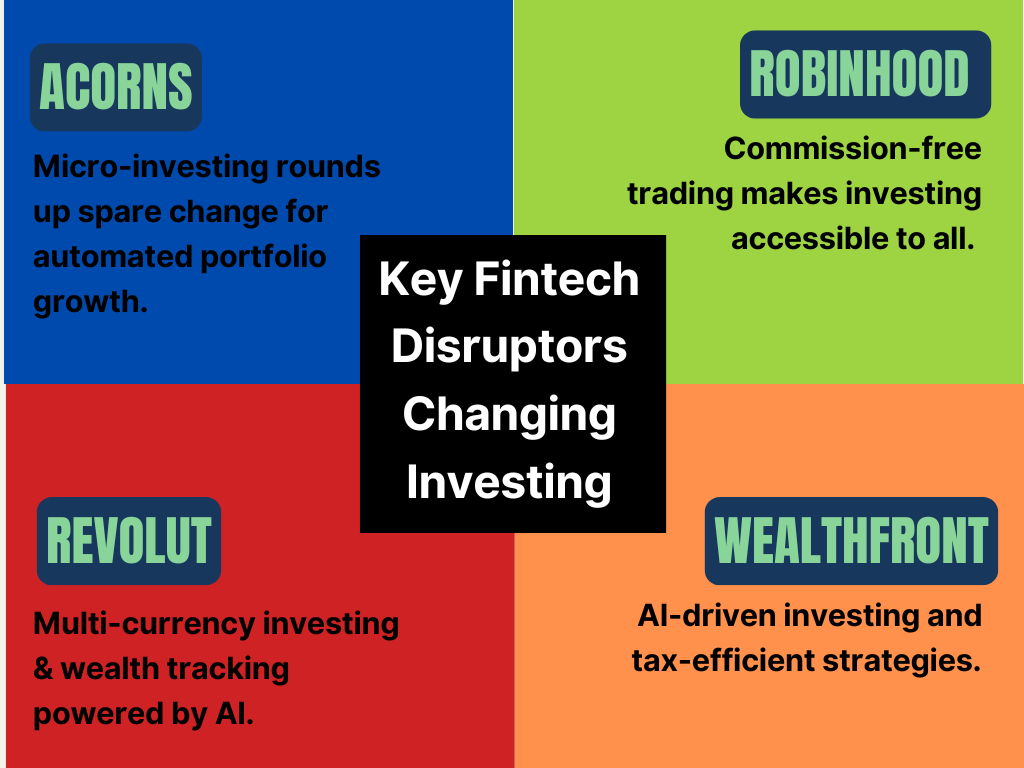

Fintech Disruptors Transforming Wealth Management

Fintech companies are revolutionizing wealth management by offering AI-powered investment platforms, real-time financial tracking, and decentralized finance (DeFi) solutions. These innovations are making investing, saving, and financial planning more accessible, cost-effective, and automated.

| Top Fintech Companies Driving Change in Wealth Management | ||

| Company | Key Offering | Impact on Wealth Management |

| Robinhood | Commission-free trading | Democratized stock & crypto investing for retail investors. |

| Acorns | Micro-investing & round-ups | Encourages automated investing by rounding up daily transactions. |

| Revolut | Multi-currency investing & wealth tracking | Enables seamless global investing with AI-driven insights. |

| SoFi | AI-powered financial planning | Provides automated wealth management & student loan refinancing. |

| Wealthsimple | Hybrid robo-advisory & crypto investing | Merges traditional investing with AI-driven asset allocation. |

AI-Powered Assistants & DeFi’s Role

Fintech apps are integrating AI-driven financial assistants that offer real-time spending analysis, tax optimization, and portfolio recommendations. Decentralized finance (DeFi) platforms, powered by blockchain technology, allow investors to lend, borrow, and trade assets without traditional financial intermediaries.

With fintech disrupting traditional banking and investment services, wealth management is becoming more autonomous, data-driven, and globally accessible than ever before.

Soniya Malik on Financial Automation & the Future of Wealth Tech

Automation is changing how people manage money. AI-driven tools help investors track their wealth, optimize spending, and make smart investment decisions without manual effort.

Soniya Malik, Founder and CEO of Akounto, believes automation is the future: “Smart wealth management isn’t just about earning—it’s about making every dollar work efficiently. Automation removes guesswork and builds long-term financial stability.”

AI-powered financial tools now handle budgeting, tax planning, and investment rebalancing in real-time. Platforms like Akounto simplify financial tracking, while robo-advisors help automate investment strategies based on user goals.

Wealth management firms are adopting AI for risk assessment, fraud detection, and portfolio management. With automation reducing human errors and emotional decision-making, investors can focus on growth and security.

As technology advances, financial automation will become even more precise, predictive, and accessible, making wealth management easier for everyone.

Challenges & Risks of AI in Wealth Management

AI has transformed wealth management, but it comes with risks. Data security, algorithmic bias, regulatory concerns, and over-reliance on automation pose challenges for investors and financial institutions.

Key Challenges

- Data Privacy & Cybersecurity Risks – AI-driven platforms collect massive financial data, making them prime targets for hackers. A security breach can expose sensitive investor details.

- Algorithmic Bias – AI models rely on historical data, which may lead to biased investment decisions, favoring certain assets while overlooking others.

- Regulatory & Compliance Issues – Governments worldwide are still catching up with AI regulations, leading to uncertainty for financial firms.

- Over-Reliance on Automation – AI lacks human judgment. Market crashes or economic shifts may require human intervention, which AI may not anticipate accurately.

How to Overcome These Risks

- Stronger Cybersecurity Measures – Wealth management firms must use multi-factor authentication, end-to-end encryption, and AI-driven fraud detection to protect investor data.

- Regular AI Audits – Financial institutions should continuously review AI models to eliminate bias and improve accuracy.

- Regulatory Compliance – Governments are working on AI regulations; firms must stay updated and adapt to legal requirements.

- Human-AI Hybrid Approach – AI should complement, not replace, human financial advisors. A balance between automation and human expertise ensures safer investment decisions.

By addressing these risks, AI can continue to enhance efficiency, security, and financial decision-making in wealth management.

AI & Fintech’s Lasting Impact on Wealth Management

AI and fintech have transformed wealth management, making investment strategies smarter, financial planning automated, and portfolio management more efficient. As AI adoption grows, financial decisions will become more data-driven, accessible, and personalized.

While automation reduces errors and optimizes wealth tracking, human expertise remains essential. A hybrid model, where AI enhances decision-making and advisors provide strategic oversight, ensures a balanced and secure approach to wealth management.

Soniya Malik, CEO of Akounto, sees AI as a financial equalizer: “Technology has made wealth management accessible to everyone, not just the ultra-rich. AI-driven tools give people more control over their money, making financial independence achievable for all.”

AI is no longer the future—it is the present. Investors who embrace automation, AI-driven insights, and fintech tools will have a stronger, more resilient financial future.